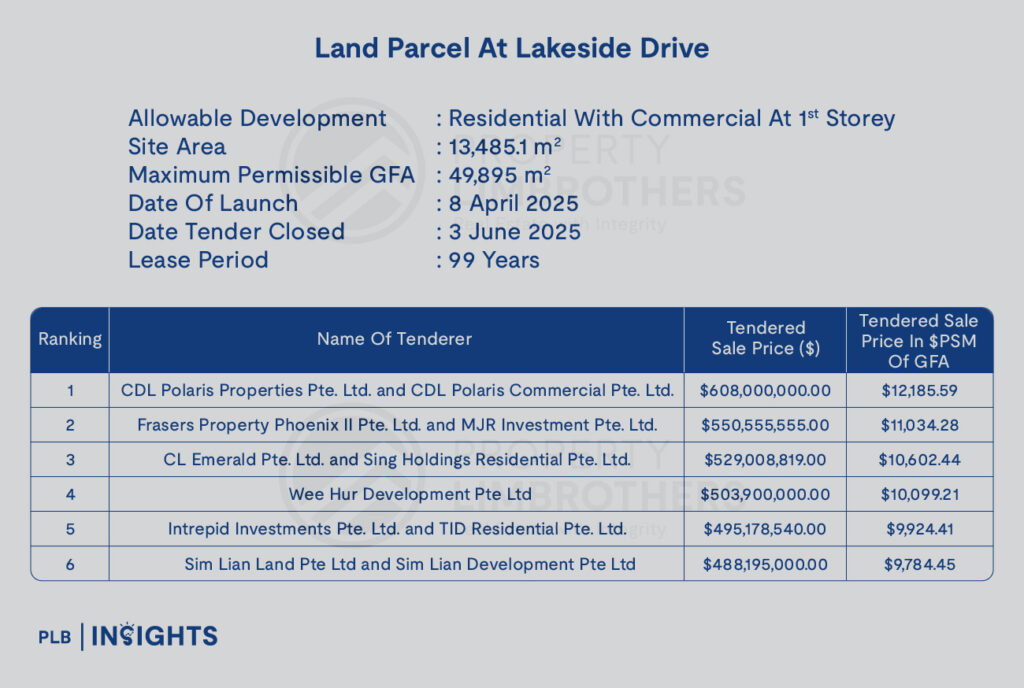

City Developments Limited (CDL) has emerged as the top bidder for the Government Land Sale (GLS) site at Lakeside Drive, with a compelling offer of $608 million, translating to $1,132 per square foot per plot ratio (psf ppr). The tender, which closed on June 3, attracted a total of six bids, marking a rebound in developer interest after recent muted GLS activity.

The next highest bid of $550.56 million ($1,025 psf ppr) came from a joint venture between Frasers Property and Mitsubishi Estate Asia — a full 10.4% below CDL’s offer. CapitaLand Development and Sing Holdings followed with a $529 million ($985 psf ppr) bid, placing them in third.

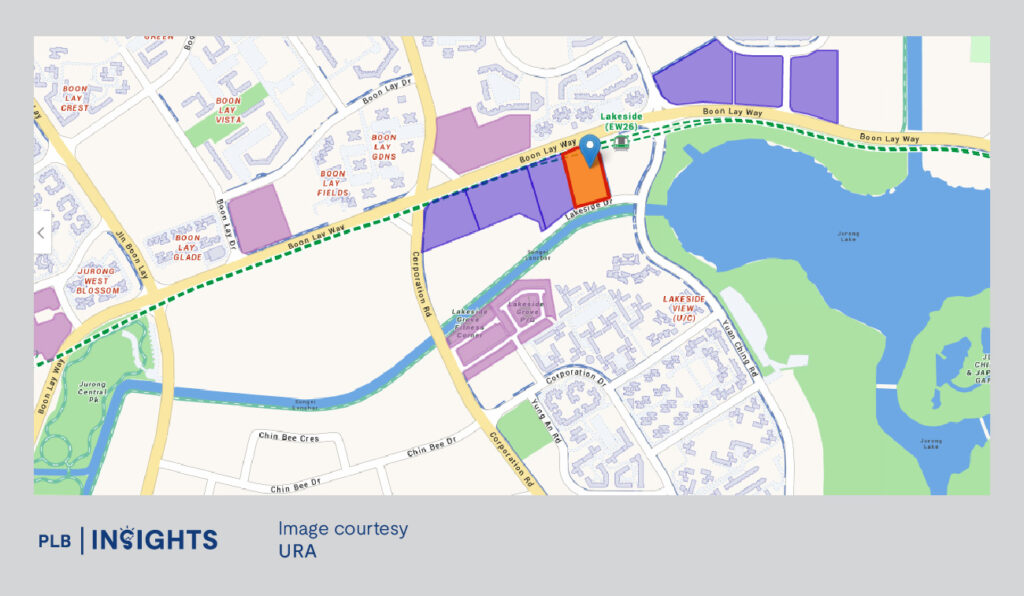

The 145,314 sq ft site, zoned for residential with first-storey commercial use, allows a gross plot ratio of 3.6 and can yield 575 residential units alongside 10,764 sq ft of commercial space. Strategically located adjacent to Lakeside MRT and within the Jurong Lake District, the site benefits from excellent connectivity and access to amenities and green spaces.

CDL has outlined its vision to develop five 16-storey residential blocks with a retail podium, offering unblocked views of the Jurong Lake Gardens. This GLS plot is the first in the Lakeside vicinity awarded in nearly a decade, making it a rare and strategic acquisition opportunity.

The Lakeside Drive tender outcome follows subdued activity in the GLS market, such as the Media Circle (Parcel B) site that drew zero bids in April and Lentor Gardens which received just two. The interest could be attributed to its attractive locational fundamentals, especially when the plot is near an MRT station, amid a cautious macroeconomic backdrop shaped by U.S. tariff uncertainties.

The 24.5% spread between the highest and lowest bids is indicative of divergent views on land valuation, cost management, and sell-through potential. Still, the strong top bid signals selective confidence in sites with strong attributes.

The land rate of $1,132 psf ppr would make this one of the most expensive OCR residential GLS plots in recent years, behind only the Bayshore Road ($1,388 psf ppr) and Clementi Avenue 1 ($1,250 psf ppr) sites.

Based on the land price, projected average selling prices could reach $2,400 psf, which would surpass 2023 launches nearby like The LakeGarden Residences ($2,134 psf) and Sora ($2,216 psf). With only approximately 300 unsold units currently in Jurong West and almost 3,000 HDB flats reaching MOP within five years, pent-up upgrader demand is expected to support the upcoming launch.

PLB Comments

This strong bid from CDL reflects renewed developer confidence in OCR land parcels with compelling location attributes — especially when the plot is adjacent to an MRT station, which significantly enhances accessibility and buyer appeal. The project is poised to reshape price expectations in the Jurong precinct and could catalyse further repositioning of the Jurong Lake District as the next prime residential enclave. We anticipate strong interest from HDB upgraders and investors alike, particularly given the limited new supply in the area and robust future demand pipeline.

Stay Updated and Let’s Get In Touch

Do not hesitate to reach out to us should you have questions!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.